Among the carbon materials discovered so far, graphene has received a lot of attention, but large-scale preparation and industrialization are difficult to achieve in a short period of time. In contrast, carbon nanotubes have become the most widely used new nanomaterials.Carbon nanotubes

Carbon nanotubes

Carbon nanotubes (CNT), also known as buckytubes, are one-dimensional quantum materials with special structures (radial dimensions are nanometers, axial dimensions are microns, and both ends of the tube are essentially sealed). Carbon nanotubes, as one-dimensional nanomaterials, are light in weight and perfectly connected in hexagonal structure.

Carbon nanotubes were discovered and manufactured in some studies before they were formally recognized, but not before they were recognized as a new and important form of carbon. It was only in 1991 that fullerene research led to the discovery and naming of carbon nanotubes by Dr Ijima of the Japanese electronics company (NEC).

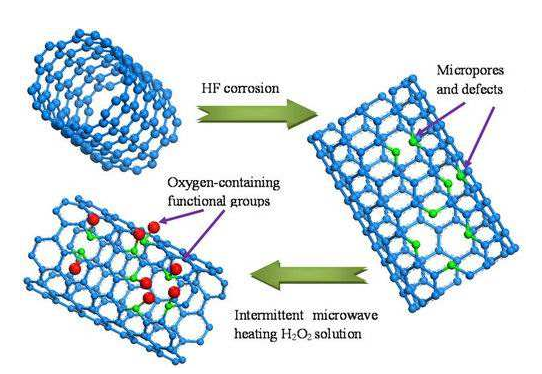

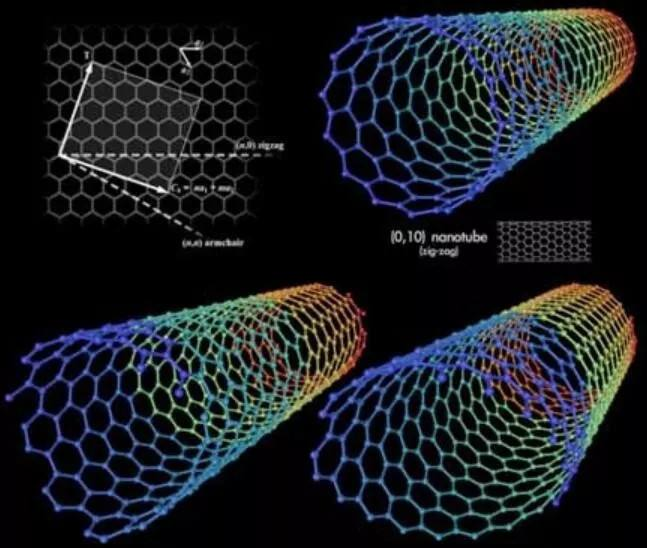

Graphene is a thick layer of single-atom carbon arranged in a honeycomb structure, while carbon nanotubes are sheets of graphene arranged in a tubular structure. The scientists divided the graphene sheets into single-walled carbon nanotubes and multi-walled carbon nanotubes according to the number of defective carbon nanotubes in the layers. In addition, carbon nanotubes can be classified into armchair nanotubes, serrated nanotubes and chiral nanotubes according to their structure characteristics. According to the conductive properties, it can be divided into metallic carbon nanotubes and semiconductor carbon nanotubes. According to whether or not there are tube wall defects, there are perfect carbon nanotubes and carbon nanotubes with defects. According to the uniformity of the shape and the overall shape is divided into straight tube, carbon nanotube bundles, Y, snake, etc

The carbon nanotube market

Compared with the “point-to-point” contact between carbon black and the active material, carbon nanotubes have higher conductive efficiency, which can reach the conductivity threshold of the whole electrode with less use, so that the active material shows better electrochemical performance and improves the energy density of the battery. Therefore, carbon nanotube products have been gradually applied in the field of lithium batteries as a new conductive agent with excellent conductivity, to improve the conductivity, cycle life and energy density of lithium batteries.

Over the next four years, global demand for carbon nanotube conductive pastes is expected to grow at a compound annual rate of 40.8%, reaching 190,600 tons by 2023. The corresponding output value is 5.54 billion yuan, of which the power contribution is 4.79 billion yuan, accounting for 86.5%. In the future, the global carbon nanotube conductive paste growth mainly comes from the following aspects: first, the demand for carbon nanotube conductive paste in China’s ternary power battery market keeps a high growth rate; Second, samsung SDI, panasonic and other Japanese and Korean companies have accelerated the introduction of carbon nanotube conductive paste in the field of lithium batteries. Third, the silicon-based cathode market is gradually expanding, increasing the demand for carbon nanotube conductive paste.

At present, China’s carbon nanotube market is small, with an output value of only 1.1 billion yuan in 2018. However, in the future, with the growth of import substitution and new energy vehicles, the industry is expected to grow rapidly. It is estimated that the market size of carbon nanotubes in China is expected to reach about 4 billion yuan in 2023. According to the statistics of GGII, carbon nanotubes have been increasing year by year since 2014, and the permeability of carbon nanotubes in power lithium batteries was 31.8% in 2018. The penetration rate is expected to increase rapidly to 82.2% by 2023.

Barriers to the carbon nanotube industry

For the carbon nanotubes industry, new entrants mainly face technical barriers, customer and market development barriers, capital barriers. At present, although carbon nanotubes have been proved to have wide application space in theory and laboratory, large-scale production of carbon nanotubes cannot be realized in a short term due to patent protection, difficulty in docking with downstream applications and other factors. Without the corresponding core technology or production process such as preparation, extraction and dispersion, carbon nanotubes manufacturing enterprises will be difficult to produce competitive products. Secondly, as one of the key auxiliary materials of lithium battery, the quality of conductive agent is closely related to the performance and safety of lithium battery. Downstream lithium battery enterprises have strict inspection procedures for conductive agent suppliers, with a long inspection period. Moreover, as an emerging industry, the carbon nanotube industry has a large capital demand for start-ups in technology research and development, production equipment acquisition and other aspects. Industry barriers restrict new entrants, leading enterprises continue to expand production and scale development, brand effect to build and enhance the trust between customers, the future industry concentration is expected to improve.